New KPMG report in the EU reveals largest increase of counterfeit cigarette consumption to date

11 JUNE 2019

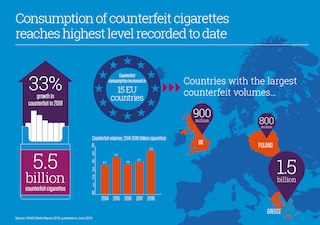

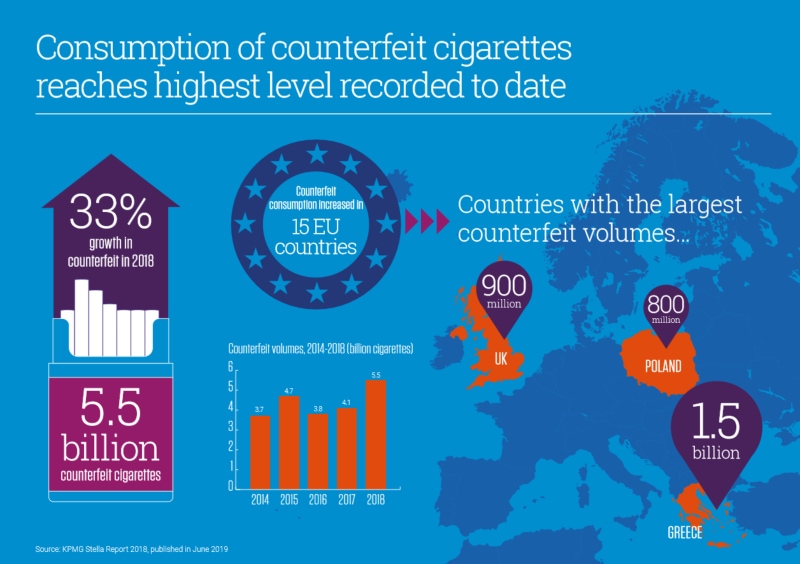

New data shows that illicit tobacco trade remains a widespread issue across the region. The study found a more than 30 percent increase in counterfeit consumption—the largest amount recorded since the KPMG measurement began.

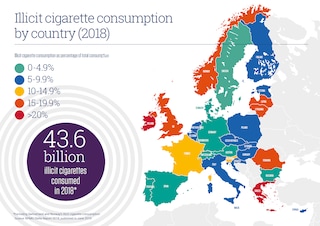

According to the Stella Report, last year there were 43.6 billion illicit cigarettes consumed in the EU. While this is slightly down compared to 2017 (by EUR 1.1 billion cigarettes in volume), the share of the total illicit cigarette market remains stable at around 8.6 percent of annual cigarette consumption. The tax loss to EU governments amounted to an astounding 10 billion euros.

Three main types of illicit tobacco: Counterfeit, contraband, and illicit whites

Counterfeit - Tobacco products that have been manufactured without the permission of the trademark rights holder.

Contraband - Genuine tobacco products that are produced for lawful distribution in their market of intended destination but illegally diverted into a different market.

Illicit whites - Tobacco products that are generally legally produced in a market and which are smuggled into another market where they have limited or no legal distribution.

Despite the overall stable levels of illicit cigarette consumption, it’s only when you look at the different elements of the illicit market that the story really emerges. Illicit whites with no country-specific labeling grew by 15 percent to 9.5 billion, while illicit whites with labeling declined by 41 percent to 3.5 billion. Volumes of contraband and other illicit cigarettes fell by 4.6 percent compared to 2017. However, the biggest move was in the consumption of counterfeit cigarettes which marked a 33 percent increase, reaching 5.5 billion cigarettes. This is the largest increase recorded since 2006, when KPMG began measuring the illicit tobacco trade consumption in the EU through a series of annual studies.

Case study

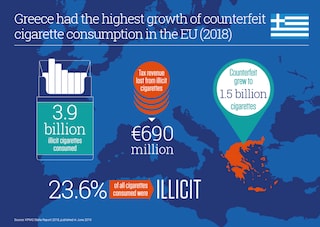

Consumption of counterfeit cigarettes in Greece: A serious problem getting worse

The counterfeit problem is particularly acute in Greece. Despite being one of the smaller European countries in terms of population, Greece has a massive market for counterfeit cigarettes. In 2018, 1.5 billion counterfeit cigarettes were sold in the country, according to KPMG. That equates to almost 140 illegal cigarettes per person in Greece.

This growing counterfeit problem contributes to a significant tax loss for the Greek government: Almost EUR 700 million annually, money that is much-needed for a country still working hard to recover from the global financial crisis.

Widespread consequences of illicit trade

Illicit trade damages many sectors, negatively impacts societies and respects neither borders nor laws. It hurts state revenues, stifles the economy and provides revenue to criminals often tied to organized crime.

Illicit trade—a major problem in several countries

Billions of illicit cigarettes are consumed every year across Europe. It’s not an isolated issue. Apart from Greece, other countries with a high share of illicit cigarette consumption are Ireland, the U.K., Norway, Latvia, Lithuania, and Romania. Indeed, the consumption of illegal cigarettes is an issue that spans all corners of the EU.

And while consumption of illicit cigarettes increased in certain countries such as Greece (detailed previously), and illicit cigarette volumes were on the rise also in the Czech Republic, Italy and U.K.—with France still remaining the largest illicit market by volume in the EU—KPMG’s report did include some encouraging news for others.

In particular, the report found declining levels of illicit cigarette consumption in EU Eastern border countries such as Poland, Estonia, and Finland, suggesting that efforts across the EU Eastern border to reduce flows through border checkpoints are bearing fruit.

Where do counterfeit and contraband cigarettes come from?

The vast majority of illicit cigarettes still come from outside the EU, with Ukraine, Belarus, Algeria, and Moldova remaining significant source countries.

The illegal cigarette trade remains a considerable problem in the EU. It requires continuous adaptation to ever-changing market dynamics—including the increase of illicit products from non-EU countries and the continued growth of counterfeit and illicit whites.

These challenges require that all concerned parties work together in a sustained and dedicated fashion to combat this scourge. Illicit trade is a complex issue, and no one government or single industry can tackle it alone; everyone has a role to play in fighting illicit trade.